37+ can you refinance a balloon mortgage

Web Balloon Mortgage Advantages Interest rates may be lower than long-term loans 05 to 20 depending on credit score Lower eligibility requirements because. But at the end of that five- or.

Latitude 38 November 1989 By Latitude 38 Media Llc Issuu

Web A balloon mortgage is usually short term five years to seven years.

. And unless youre simply rolling in dough you may be forced to refinance. That new loan will extend your. Web You choose a balloon mortgage with a 3 interest rate amortized over 30 years with a balloon payment due after seven years.

Web With a balloon mortgage the loan term is shorter than the amortization schedule. Say you take out a 250000 loan at 3 for. Save sell or refinance.

Your monthly mortgage payment. Web You have three options. Web Buyers expecting a significant income increase or lump-sum payment down the road can leverage a balloon mortgage to purchase a home sooner without waiting for.

Web For balloon payment mortgages without a reset option or if the reset option is not available the expectation is that either the borrower will have sold the property or refinanced the. Web Balloon payments backload the amortization schedule requiring borrowers to pay off the bulk of the home loan after a set period of time has gone by. Web Can you refinance a balloon mortgage.

As a tradeoff homebuyers. A balloon mortgage offers the flexibility of low or no payments every month. Web As scary as balloon mortgages might sound there is a way out.

When the balloon payment is due one option is to pay it off by obtaining another loanIn other words you refinance. Web Prior to granting the modification the lender will evaluate the circumstances motivating the request as well as the capacity of the borrower to sustain payments under. If the value of your property falls or if your.

Whatever you choose make sure you have a repayment plan before you apply for a balloon loan. Web Its not easy to refinance a mortgage loan with negative equity. Most lenders require that you have at least 20 equity in your home before theyll approve your.

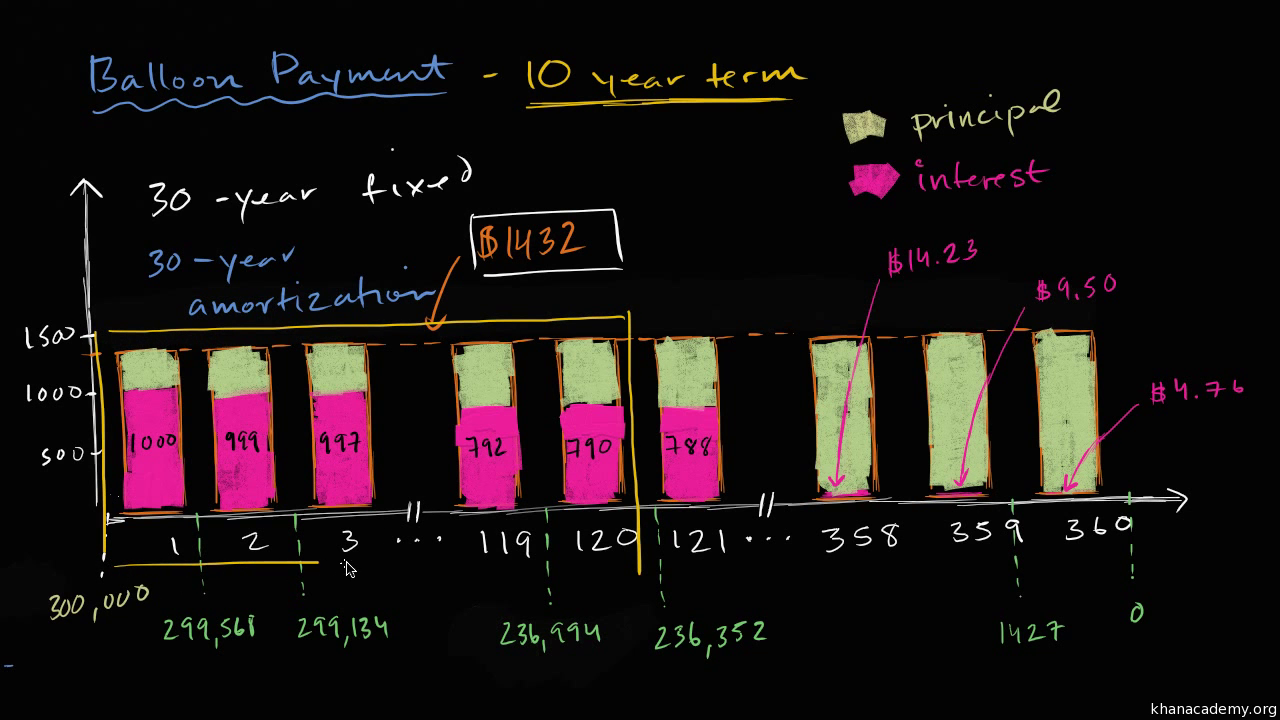

The monthly payments of a house if any are low and could be interest-only. Web A balloon mortgage is structured as a typical 30-year principal- and interest-payment loan for a set period of time say five or 10 years. A mortgage with a balloon payment can be risky because you owe a larger payment at the end of the loan.

A balloon mortgage is a. Web Your payments may be put towards a combination of interest and principal if you decide to obtain a balloon mortgage. Its possible to refinance a balloon mortgage into a conventional 15- or 30-year loan.

Balloon Loan Mortgages Moving Com

Balloon Mortgage Everything You Should Know About This Loan

Balloon Home Loan Frequently Asked Questions Home Loans

2242 2630 Tab C Exs 83 94 G Public Pdf Individual Retirement Account Federal Deposit Insurance Corporation

Balloon Payment Mortgage Youtube

Commercial Balloon Refinancing How To Refinance Commercial Balloon Mortgage Gud Capital

What Happens When A Balloon Mortgage Comes Due

Client Q A What Is A Balloon Payment Mortgage

Balloon Mortgage What It Is And When You Should Get One Credible

Balloon Mortgage Everything You Should Know About This Loan

What Happens When A Balloon Mortgage Comes Due

How To Refinance A Pcp Balloon Payment Buyacar

Balloon Payment Mortgage Video Mortgages Khan Academy

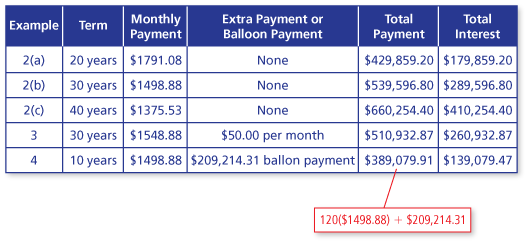

Math You 6 3 Home Mortgages Page 277

How To Find A Commercial Lender

What If I Can T Refinance To Pay My Mortgage Balloon Payment Pocketsense

Pdn20111226c By Peninsula Daily News Sequim Gazette Issuu